Seamless Transactions: Exploring E-commerce Payment Choices

The landscape of e-commerce is ever-evolving, and one crucial aspect that significantly impacts the consumer experience is the array of payment options available. This article delves into the diverse world of e-commerce payment options, examining their significance, trends, and the implications for businesses and consumers alike.

The Significance of Diverse Payment Options

In the dynamic realm of e-commerce, providing diverse payment options is paramount. Customers have varied preferences and comfort levels with different payment methods. From traditional credit and debit cards to digital wallets, buy now, pay later options, and even cryptocurrency, offering a range of choices ensures that businesses cater to a broader audience, enhancing accessibility and convenience.

Credit and Debit Cards: The Foundation of E-commerce Transactions

Credit and debit cards remain the cornerstone of online transactions. Widely accepted and familiar to consumers, they facilitate seamless transactions. However, as the e-commerce landscape evolves, newer payment methods are gaining prominence, offering additional features and addressing specific consumer needs.

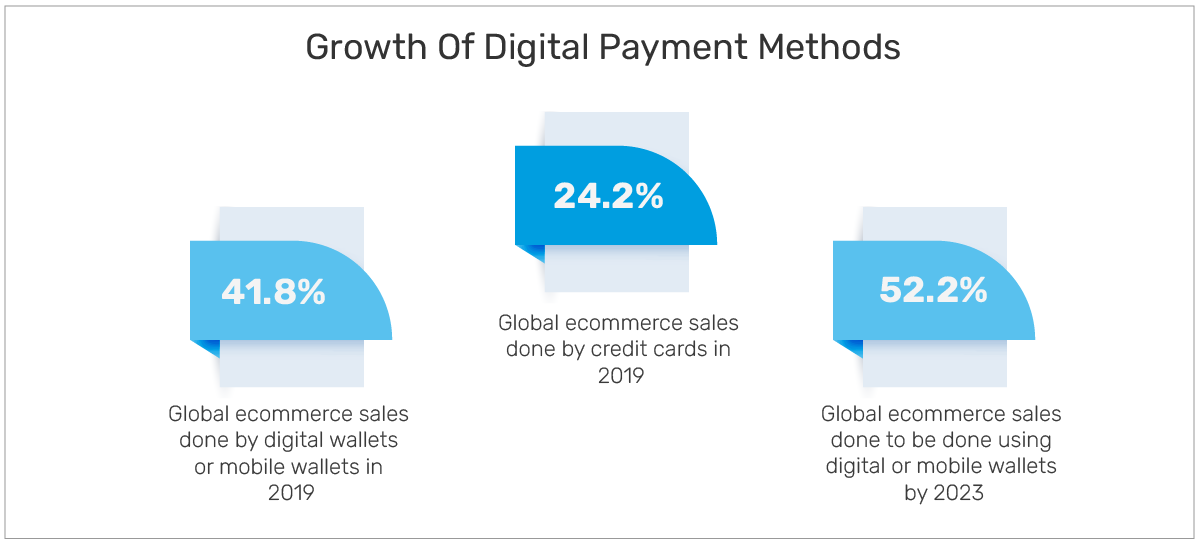

Digital Wallets: Convenience at Your Fingertips

Digital wallets have surged in popularity, providing users with a convenient and secure way to make online payments. Services like PayPal, Apple Pay, and Google Pay store users’ payment information, streamlining the checkout process. The simplicity and speed of digital wallet transactions appeal to users seeking efficiency in their online shopping experience.

Buy Now, Pay Later: Shaping Consumer Behavior

The “buy now, pay later” (BNPL) model is transforming how consumers approach online purchases. This option, offered by platforms like Afterpay and Klarna, allows shoppers to split their payments into installments. While it provides financial flexibility, businesses need to carefully consider the impact of BNPL on their revenue streams and customer relationships.

Cryptocurrency: Navigating the World of Digital Assets

The rise of cryptocurrency introduces a new dimension to e-commerce payments. Some businesses now accept digital currencies like Bitcoin and Ethereum. While this option aligns with the principles of decentralization and security, the volatility of cryptocurrencies poses challenges. However, as the regulatory landscape evolves, cryptocurrency could become a more mainstream e-commerce payment choice.

Contactless Payments: A Hygienic Revolution

In the wake of global events, contactless payments have seen a surge in adoption. Near Field Communication (NFC) technology enables contactless payments using smartphones, smartwatches, or contactless cards. This not only enhances the speed of transactions but also aligns with the increased emphasis on hygiene and safety in the current environment.

Mobile Payment Apps: Transforming Transactions on the Go

Mobile payment apps, such as Venmo and Cash App, are reshaping how users handle transactions. These apps facilitate peer-to-peer payments, splitting bills, and even making small-scale purchases. The social integration of these platforms adds a layer of convenience, especially for younger demographics accustomed to seamless digital interactions.

Biometric Authentication: Enhancing Security

As security concerns persist in the digital landscape, biometric authentication methods are gaining traction. Fingerprint recognition, facial recognition, and even iris scans provide an additional layer of security for e-commerce transactions. Integrating biometrics ensures that businesses not only offer convenience but also prioritize the protection of sensitive user information.

The Role of Regulatory Compliance

With the proliferation of diverse e-commerce payment options, regulatory compliance becomes crucial. Businesses must adhere to data protection regulations, payment industry standards, and evolving legal frameworks. Maintaining compliance not only safeguards customer data but also fosters trust in the brand, contributing to a positive overall customer experience.

Future Trends: Anticipating the Next Wave

The e-commerce payment landscape is dynamic, with ongoing innovations shaping future trends. Central Bank Digital Currencies (CBDCs), increased use of Artificial Intelligence (AI) for fraud prevention, and the integration of voice-activated payments are just a few examples of what the future may hold. Staying abreast of these trends positions businesses to adapt and capitalize on emerging opportunities.

Explore the World of E-commerce Payment Options at TheJuon.com

In conclusion, the diverse array of e-commerce payment options reflects the dynamic nature of online transactions. Businesses that offer flexibility and cater to evolving consumer preferences position themselves for success in the competitive e-commerce landscape. For in-depth insights and resources on navigating the world of e-commerce payments, visit TheJuon.com.