What are Seamless Payments?

Seamless payments represent a significant shift in how we think about transactions. Gone are the days of clunky checkout processes, multiple redirects, and frustrating form-filling. Seamless payments aim to integrate payment processing directly into the user experience, making it as invisible and frictionless as possible. This involves embedding payment options within applications, websites, or even physical devices, allowing users to complete purchases with minimal disruption to their workflow.

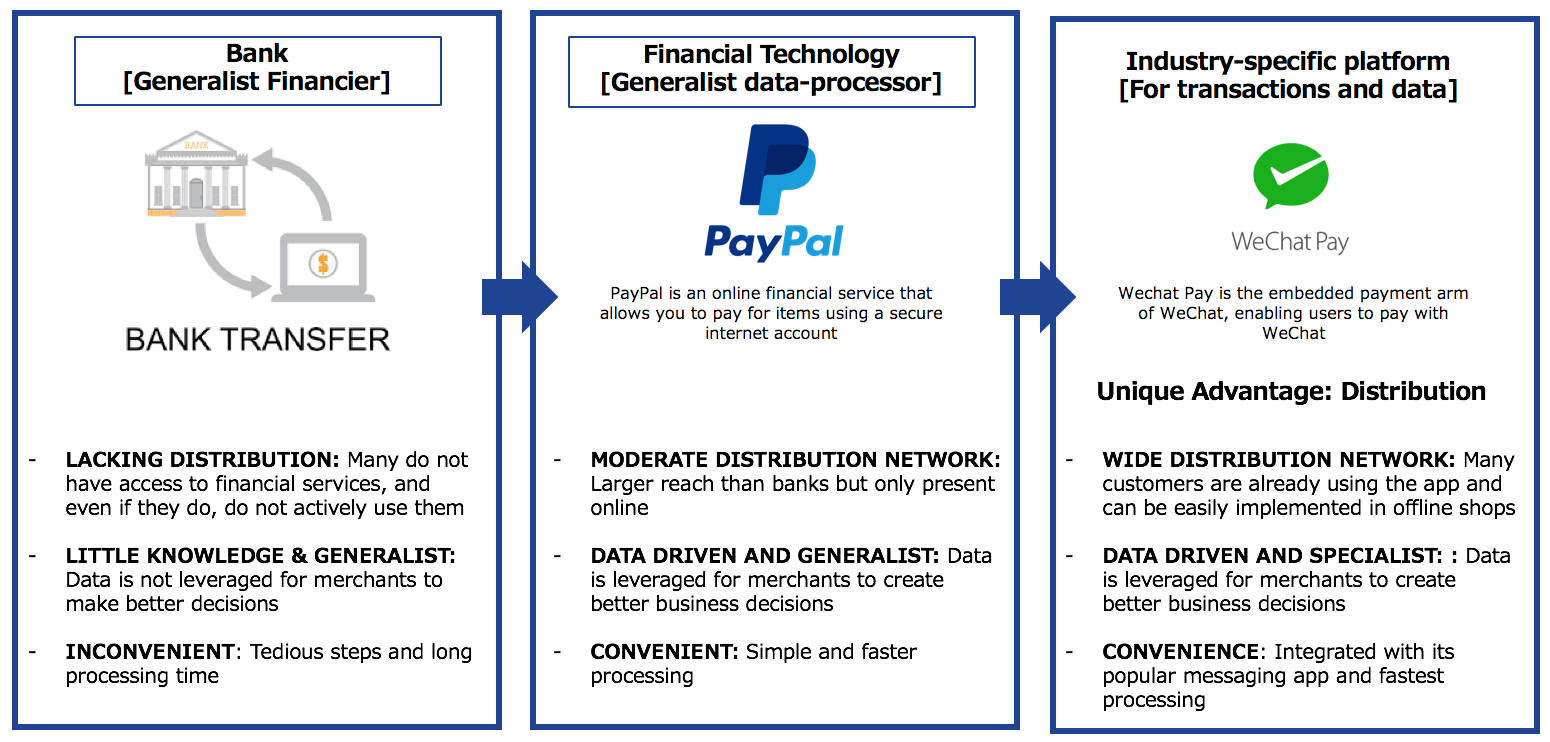

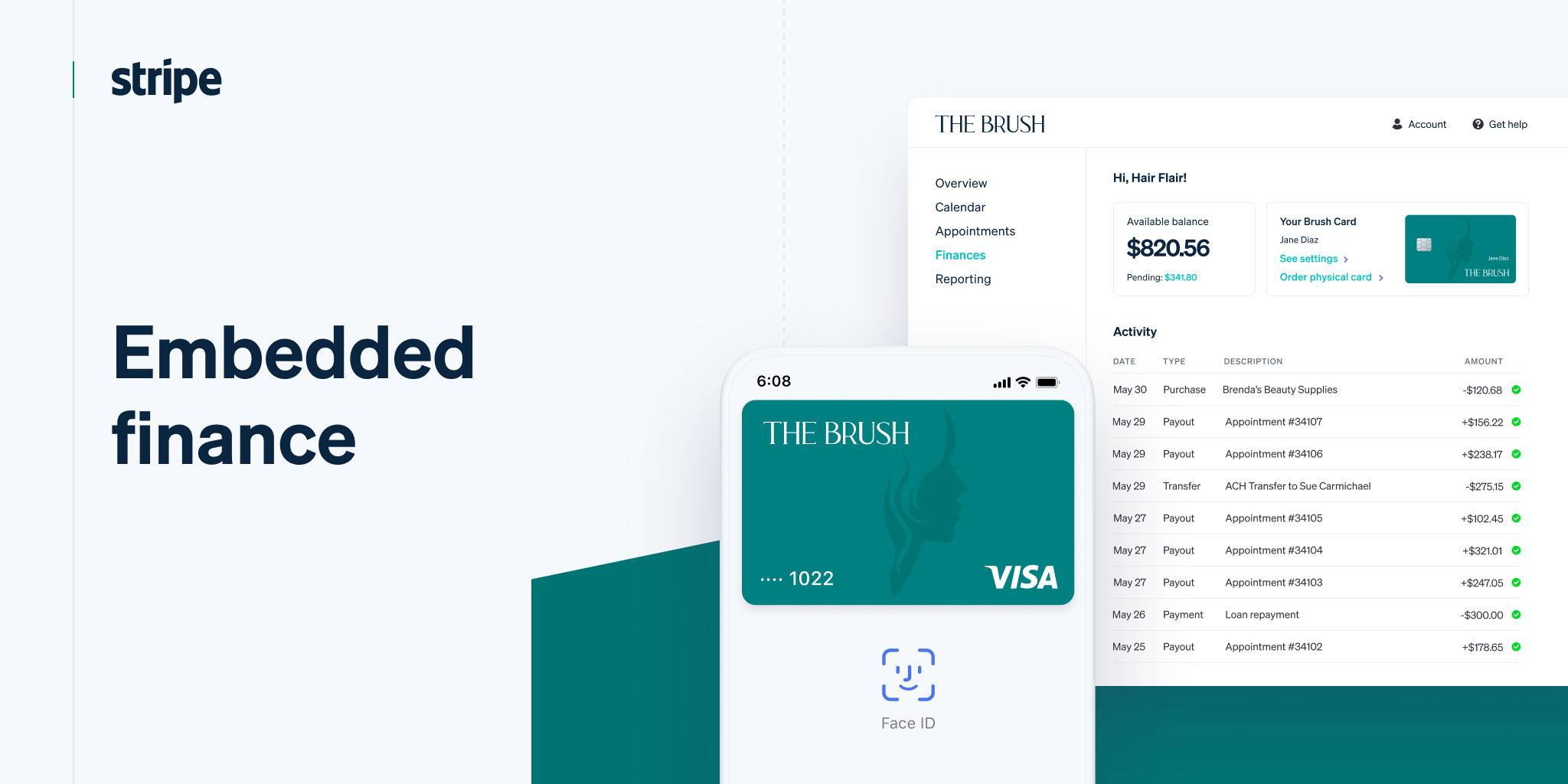

The Rise of Embedded Finance

The emergence of seamless payments is intrinsically linked to the broader trend of embedded finance. Embedded finance involves integrating financial services directly into non-financial platforms. Instead of directing users to a separate financial institution, businesses are now able to offer payment options, lending services, insurance, and other financial products directly within their existing platforms. This offers a more convenient experience for the user and opens up new revenue streams for businesses.

Key Features of a Seamless Payment Platform

A successful seamless payment platform needs several key features. Speed and efficiency are paramount – transactions should be completed quickly and without delays. Security is crucial, requiring robust encryption and fraud prevention measures. Flexibility is another important aspect; the platform should support various payment methods, including credit cards, debit cards, digital wallets, and buy now, pay later (BNPL) options. Finally, a user-friendly interface is essential for a positive customer experience. The entire process should be intuitive and easy to understand, regardless of the user’s technical proficiency.

Benefits for Businesses

Integrating a seamless payment platform offers substantial advantages for businesses. Increased conversion rates are a major benefit; the smoother checkout experience reduces cart abandonment. Improved customer satisfaction leads to greater loyalty and positive word-of-mouth marketing. Streamlined operations result in reduced processing costs and time saved on manual tasks. Furthermore, businesses can gain valuable customer data through seamless payment platforms, enabling targeted marketing and personalized offers.

Benefits for Consumers

The advantages for consumers are equally significant. Seamless payments offer greater convenience and speed. Users can complete purchases quickly and easily, without the need to navigate to a separate payment gateway. Enhanced security features protect against fraud and data breaches. The wider availability of payment methods caters to diverse preferences and financial situations. Ultimately, a seamless payment experience enhances the overall user satisfaction and fosters trust in the brand.

Technology Behind Seamless Payments

Several technologies underpin the functionality of seamless payment platforms. Application Programming Interfaces (APIs) play a crucial role, enabling seamless communication between the payment platform and the host application. Tokenization protects sensitive card details by replacing them with unique tokens, enhancing security. Real-time payment processing ensures that transactions are completed instantly. Advanced analytics capabilities provide valuable insights into customer behavior and purchasing patterns, enabling businesses to optimize their strategies.

Examples of Seamless Payment Integration

We are already seeing numerous examples of seamless payment integration across various industries. Ride-hailing apps like Uber and Lyft seamlessly process payments within their apps. E-commerce platforms are increasingly embedding checkout processes directly within their websites, minimizing user disruption. Subscription services often utilize recurring billing options for seamless payment processing. The integration is becoming increasingly prevalent in various sectors, showcasing its effectiveness and expanding reach.

The Future of Seamless Payments

The future of seamless payments looks bright. We can expect to see further advancements in areas like biometric authentication and artificial intelligence (AI)-powered fraud detection. The integration of emerging payment technologies, such as cryptocurrencies and decentralized finance (DeFi) solutions, will also shape the landscape. As technology continues to evolve, seamless payments will become even more ubiquitous, integrated, and intuitive, transforming how we conduct transactions in our daily lives.

Addressing Security Concerns

While the convenience of seamless payments is undeniable, addressing security concerns is crucial. Robust security protocols are essential to protect user data and prevent fraud. This includes implementing strong encryption, multi-factor authentication, and real-time fraud detection systems. Regular security audits and updates are necessary to maintain a high level of protection against emerging threats. Transparency with users about data handling practices is also crucial for building trust and fostering confidence in the platform.

Seamless Payments and the Customer Experience

Ultimately, the success of seamless payments hinges on providing a positive customer experience. A well-designed platform should be intuitive, user-friendly, and reliable. Fast transaction speeds, multiple payment options, and clear communication contribute to a positive experience. By prioritizing the customer journey, businesses can leverage seamless payments to improve brand loyalty, increase sales, and enhance their overall market position. A smooth and efficient payment process translates directly into a satisfied customer base and long-term success. Learn more about embedded finance platforms here.