What is Banking as a Service (BaaS)?

Banking as a Service (BaaS) is revolutionizing the financial landscape. It’s essentially a model where banks provide their core banking functionalities – such as account opening, payments processing, and fraud detection – through APIs (Application Programming Interfaces) to third-party providers. These providers, which can range from fintech startups to established businesses, then integrate these banking services into their own applications and platforms, offering a seamless financial experience to their customers.

BaaS: Empowering Fintech Innovation

The impact of BaaS on the fintech sector is undeniable. Fintech companies, often lacking the resources and infrastructure to build their own banking systems from scratch, can now leverage the existing capabilities of established banks. This allows them to focus on developing innovative financial products and services, improving customer experience, and reaching new markets more quickly and efficiently. Think of embedded finance, where financial services are seamlessly integrated into non-financial applications – BaaS is the engine that powers this trend.

Enhanced Customer Experience Through Seamless Integration

For consumers, BaaS translates to a smoother and more integrated financial experience. Imagine managing your investments, paying bills, and tracking your spending all within a single app, without ever having to switch between different banking platforms. This seamless integration is a direct result of BaaS, allowing businesses to offer customized and personalized financial services that fit seamlessly into their customers’ existing workflows.

Increased Efficiency and Reduced Costs for Businesses

BaaS isn’t just beneficial for consumers and fintech companies; it offers significant advantages for businesses as well. By integrating banking services via APIs, companies can automate financial processes, reduce manual data entry, and streamline operations. This translates to significant cost savings, improved efficiency, and faster transaction processing. The elimination of the need to build and maintain complex banking infrastructure is a significant cost-saving factor.

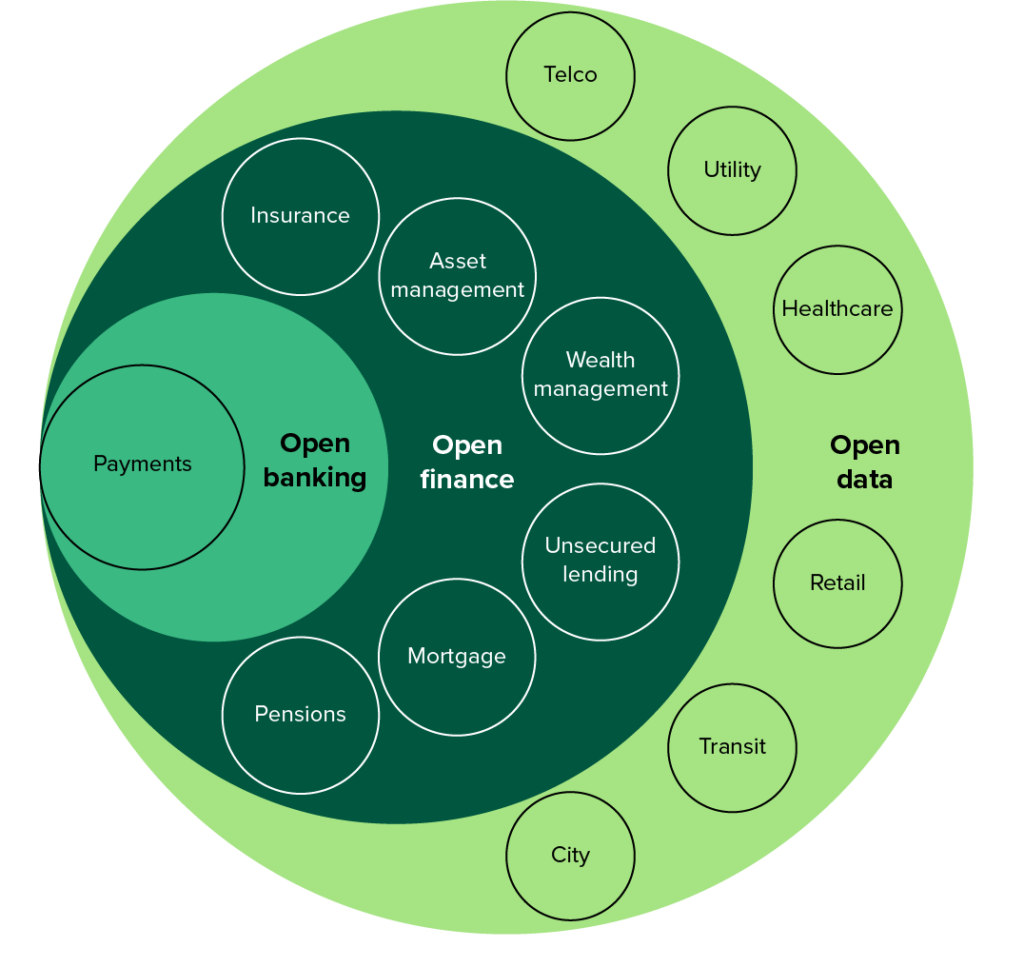

The Rise of Embedded Finance: BaaS as a Catalyst

Embedded finance is the perfect example of BaaS in action. This refers to the integration of financial services into non-financial platforms and applications. For instance, a ride-sharing app might integrate payments directly through BaaS, allowing users to pay their fares seamlessly without leaving the app. This creates a more convenient and streamlined experience for users while generating new revenue streams for the ride-sharing company.

Addressing Regulatory Challenges and Security Concerns

While BaaS presents numerous opportunities, it also presents regulatory and security challenges. Data privacy and security are paramount, requiring robust security measures and compliance with relevant regulations. The regulatory landscape surrounding BaaS is still evolving, and companies need to navigate these complexities carefully to ensure compliance and maintain customer trust. Working with established and reputable banking partners is crucial in mitigating these risks.

The Future of BaaS: Expanding Horizons

The future of BaaS looks incredibly bright. As the technology matures and regulatory frameworks become clearer, we can expect to see even greater innovation and wider adoption. The potential applications are vast, ranging from personalized financial advice embedded in health apps to streamlined cross-border payments integrated into e-commerce platforms. BaaS is not just changing the way we interact with financial services; it’s fundamentally reshaping the financial landscape itself.

Competition and Collaboration in the BaaS Ecosystem

The BaaS market is becoming increasingly competitive, with both traditional banks and fintech companies vying for market share. However, collaboration is also a key trend. Banks are partnering with fintech companies to leverage their expertise in technology and innovation, while fintechs are relying on banks for their regulatory compliance and access to financial infrastructure. This collaborative approach is essential for the continued growth and success of the BaaS ecosystem.

BaaS and the Democratization of Finance

Ultimately, BaaS contributes to the democratization of finance. By making banking services more accessible and affordable, BaaS empowers businesses and individuals who might have previously lacked access to traditional financial institutions. This has the potential to drive financial inclusion and economic growth, particularly in underserved communities and developing markets. The ability to easily integrate financial services into various platforms opens up opportunities for financial products to reach a far wider audience. Learn more about embedded finance vs. banking as a service here.