What is Green Investing?

Green investing, also known as sustainable investing or responsible investing, encompasses a wide range of strategies aimed at generating financial returns while promoting environmental and social good. It’s not just about avoiding “bad” companies; it’s about actively seeking out businesses that are contributing to a more sustainable future. This could involve investing in companies focused on renewable energy, clean technology, sustainable agriculture, or resource efficiency. It can also include investing in companies with strong environmental, social, and governance (ESG) profiles, meaning they demonstrate responsible practices across their operations.

The Financial Benefits of Green Investing

Contrary to some misconceptions, green investing isn’t solely about altruism. Many studies have shown that sustainable investments can perform just as well, or even better, than traditional investments over the long term. Companies committed to sustainability often demonstrate better risk management, innovation, and long-term planning, all of which can translate into stronger financial performance. Investors are increasingly recognizing the link between a company’s environmental and social impact and its financial success. The growing demand for sustainable products and services is also a significant driver of growth in this sector.

Types of Green Investments

The world of green investing offers a diverse range of options. You can invest in green bonds, which finance environmentally friendly projects like renewable energy infrastructure. There are also exchange-traded funds (ETFs) and mutual funds that specifically track companies with strong ESG ratings. Direct investment in companies pioneering sustainable technologies is another avenue. Finally, you can explore impact investing, which prioritizes generating measurable social and environmental impact alongside financial returns. The choice depends on your investment goals, risk tolerance, and desired level of impact.

Identifying Truly Green Companies

Navigating the green investing landscape requires careful due diligence. “Greenwashing,” where companies exaggerate their environmental credentials, is a real concern. Therefore, it’s crucial to look beyond marketing claims and delve into a company’s actual practices. Examine their sustainability reports, assess their carbon footprint, and scrutinize their supply chains. Third-party certifications and independent ESG ratings can provide valuable insights into a company’s true commitment to sustainability. Remember that transparency is key when evaluating a potential green investment.

The Environmental Impact of Green Investing

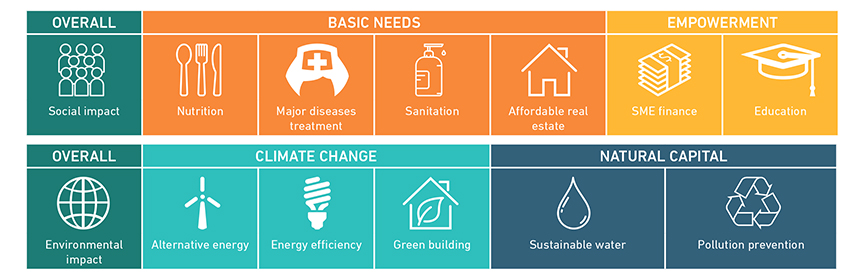

Beyond the financial benefits, green investing plays a vital role in addressing pressing environmental challenges. By channeling capital towards sustainable solutions, investors directly contribute to the transition to a cleaner, greener economy. This can involve supporting the development of renewable energy sources, promoting energy efficiency, reducing carbon emissions, and conserving natural resources. The collective impact of many individuals and institutions choosing green investments can be transformative, accelerating the shift away from unsustainable practices and fostering a more sustainable future for all.

Beyond Profits: The Social Impact of Green Investing

The positive effects of green investing extend beyond environmental concerns. Many sustainable businesses prioritize fair labor practices, ethical sourcing, and community engagement. Investing in these companies supports a more equitable and just world. For example, investments in companies promoting sustainable agriculture can help ensure food security and improve livelihoods in developing countries. By aligning your investments with your values, you can contribute to positive social change while potentially achieving attractive financial returns.

Getting Started with Green Investing

Entering the world of green investing doesn’t require specialized knowledge or vast sums of money. Many resources are available to help you get started. You can begin by researching different types of green investments and understanding your risk tolerance. Consider consulting with a financial advisor who specializes in sustainable investing to help you develop a personalized strategy aligned with your goals. Numerous online platforms and educational resources provide information and tools to support your journey towards responsible and impactful investing. Remember to start small, learn as you go, and adjust your strategy as you gain more experience.

Long-Term Vision for a Sustainable Future

Green investing is more than just a trend; it’s a long-term investment in a more sustainable future. As awareness of climate change and social responsibility grows, the demand for green investments will only continue to increase. By embracing green investing, you can contribute to a healthier planet and potentially secure a more resilient and profitable investment portfolio. It’s about aligning your financial goals with your values and making a difference, one investment at a time. Visit here for sustainable investing ideas.