The Growing Appeal of Sustainable Investing

For years, the idea of “doing good” while investing was often seen as a niche pursuit, a trade-off between ethical principles and financial returns. However, that perception is rapidly changing. Sustainable investing, also known as Environmental, Social, and Governance (ESG) investing, is experiencing explosive growth, fueled by a rising awareness of climate change, social inequality, and the increasing demand from investors for transparency and accountability from companies. This shift isn’t just driven by altruism; it’s increasingly recognized as a smart financial strategy.

Beyond “Feel-Good” Investing: The Financial Case for Sustainability

The misconception that sustainable investing sacrifices profitability is being debunked. Numerous studies show that companies with strong ESG performance often outperform their less sustainable counterparts in the long run. This is because sustainable practices often lead to increased efficiency, reduced risk, improved brand reputation, and enhanced access to capital. For instance, companies prioritizing energy efficiency can lower operating costs, while those with strong employee relations tend to experience higher productivity and lower turnover. These positive factors translate into stronger financial performance, attracting investors seeking both returns and impact.

Identifying Sustainable Investments: Navigating the Landscape

The sustainable investing landscape can seem overwhelming. There’s a wide range of options, from companies explicitly focused on renewable energy to those with strong ESG ratings across multiple areas. It’s crucial to understand the different approaches. Some investors focus on excluding certain industries (like fossil fuels or tobacco), while others actively seek out companies with positive environmental and social impacts. Independent ratings agencies provide ESG scores for companies, but it’s important to remember that these scores are not without their limitations and should be viewed as one piece of the investment puzzle. Due diligence and understanding a company’s actual practices remain essential.

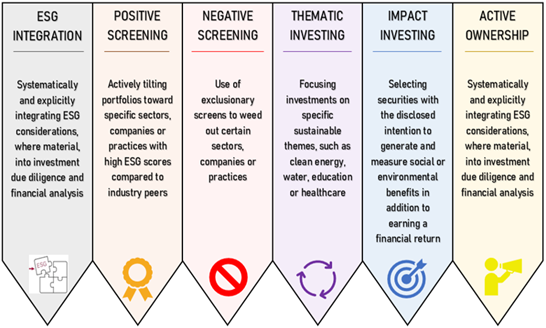

Different Approaches to Sustainable Investing: Finding Your Fit

Sustainable investing isn’t a one-size-fits-all approach. Investors can choose from several strategies, each with its own level of engagement and impact. Some opt for passively managed funds that track ESG indices, offering diversified exposure to sustainable companies. Others prefer actively managed funds where fund managers actively select companies based on rigorous ESG criteria. Impact investing goes a step further, targeting investments that directly address specific social and environmental problems, seeking both financial returns and measurable social good. The choice depends on individual risk tolerance, financial goals, and the degree of impact desired.

The Role of Transparency and Accountability

The success of sustainable investing relies heavily on transparency and accountability. Investors need access to reliable and comparable data on a company’s ESG performance. While progress is being made in standardizing ESG reporting, inconsistencies and greenwashing (making misleading claims about environmental performance) remain significant challenges. Therefore, critical evaluation of company disclosures, independent verification of ESG claims, and engagement with companies on their sustainability practices are crucial for ensuring genuine impact and avoiding investments that fall short of expectations.

Long-Term Vision and Patience: A Key Ingredient for Success

Sustainable investing often requires a long-term perspective. The positive financial impacts of sustainable practices may not be immediately apparent, and market fluctuations can influence short-term returns. However, the long-term potential for both financial growth and positive societal impact is significant. Patience and a commitment to responsible investing are key to realizing the full benefits of this approach. Remember that while financial returns are important, the lasting positive effects on the environment and society are also critical elements of a successful sustainable investing strategy.

The Future of Sustainable Investing: A Growing Movement

The growing awareness of climate change, social justice issues, and the interconnectedness of environmental, social, and economic factors is driving an irreversible shift in the investment world. Sustainable investing is no longer a niche strategy but a mainstream approach embraced by institutional and individual investors alike. As the demand for transparency and accountability increases, and as data and analytical tools improve, sustainable investing will continue to evolve, offering both financial rewards and the satisfaction of contributing to a more sustainable and equitable future. The future looks bright for those who combine financial acumen with a commitment to doing good. Read also about ESG sustainable investing.