What is Embedded Finance?

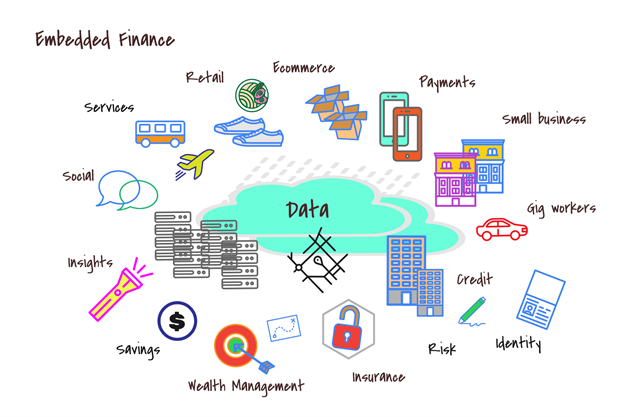

Embedded finance is the seamless integration of financial services into non-financial platforms or applications. Instead of directing users to a separate banking or financial institution website, embedded finance brings the financial transaction directly into the user experience. Think of buying insurance alongside booking a flight, or paying for a purchase directly within a gaming app. This integration removes friction, making financial tasks quicker and more convenient for the consumer.

The Rise of Embedded Finance: A User-Centric Approach

The growth of embedded finance is largely driven by consumer demand. People increasingly prefer convenient and streamlined experiences. Nobody wants to be redirected to a separate site to complete a simple payment or manage their finances. Embedded finance responds directly to this desire for simplicity, offering a unified and frictionless user journey. This, in turn, fosters brand loyalty for businesses that integrate these services effectively.

Simplifying Payments: A Key Benefit of Embedded Finance

One of the most significant advantages of embedded finance is its capacity to simplify payment processes. By integrating payment gateways directly into their platforms, businesses can offer a variety of payment methods, from credit and debit cards to digital wallets and buy-now-pay-later options. This choice empowers consumers, caters to diverse preferences, and significantly reduces cart abandonment rates – a major concern for e-commerce businesses.

Beyond Payments: Expanding the Scope of Embedded Finance

While payment simplification is a central aspect, embedded finance extends far beyond mere transactions. It encompasses a wide array of financial services, including lending, insurance, investment, and budgeting tools. Imagine requesting a loan directly within a business management software, or purchasing travel insurance within a flight booking app. These integrations provide a holistic financial experience, enhancing the overall value proposition of the non-financial platform.

The Technological Enablers of Embedded Finance

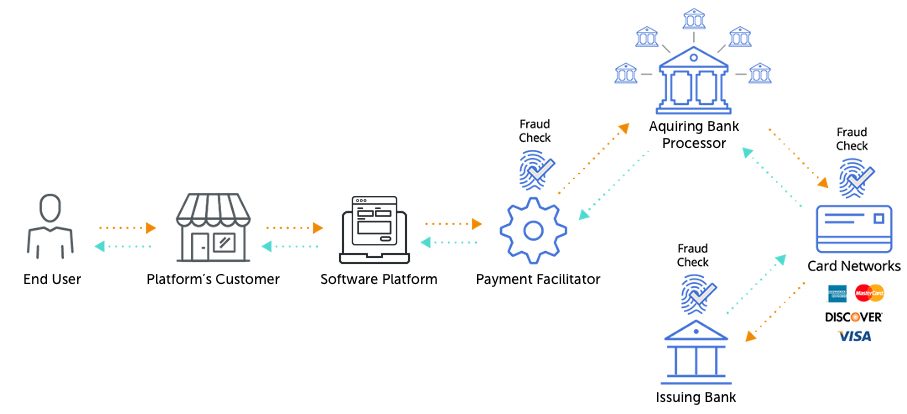

The rapid advancements in technology have been pivotal in fueling the embedded finance revolution. Open APIs (Application Programming Interfaces) play a crucial role, allowing different platforms to securely communicate and exchange financial data. Cloud computing offers the scalability and infrastructure necessary to handle the increasing volume of transactions. Furthermore, robust security protocols are essential to maintain the integrity and protect the sensitive financial information involved.

Benefits for Businesses Integrating Embedded Finance

For businesses, integrating embedded finance offers a multitude of benefits. Increased customer engagement and retention are key advantages. By providing a seamless financial experience, businesses cultivate stronger relationships with their customers. Furthermore, offering financial products and services can generate new revenue streams and enhance profitability. The added convenience for customers often translates into increased sales and repeat business.

Challenges and Considerations in Implementing Embedded Finance

Despite its advantages, implementing embedded finance comes with its own set of challenges. Regulatory compliance varies across jurisdictions, requiring businesses to navigate complex legal and financial landscapes. Security remains a paramount concern, necessitating robust security measures to protect user data and prevent fraud. Furthermore, integrating financial services seamlessly into existing platforms requires careful planning and technical expertise.

The Future of Embedded Finance: A Seamless Financial Ecosystem

The future of embedded finance looks promising. We can anticipate even more sophisticated integrations, offering personalized financial solutions tailored to individual user needs. The lines between traditional financial institutions and non-financial businesses will continue to blur, creating a more interconnected and seamless financial ecosystem. This evolution will ultimately empower consumers with greater control and convenience over their financial lives.

Addressing Security Concerns in Embedded Finance

Security is a critical aspect of embedded finance. Robust security protocols, including encryption and multi-factor authentication, are crucial for protecting sensitive financial data. Regular security audits and penetration testing are necessary to identify and address potential vulnerabilities. Compliance with relevant data privacy regulations, such as GDPR and CCPA, is paramount to build consumer trust and ensure legal compliance. Learn more about embedded finance providers.